When you start a new job or get a raise, you'll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isn't a simple matter of multiplying your hourly wage by the number of hours you'll work each week, or dividing your annual salary by 52. That's because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you'll take home. Salary to hourly wage calculator lets you see how much you earn over different periods.

It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these.

Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. If you earn $65,000 as an annual salary, you would be receiving a monthly pre-tax salary of $5,416.67, a weekly pay of $1,250, and an hourly wage of $31.25 per hour. These calculations assume you work a 40-hour week for 52 weeks of the year. If you earn $50,000 as an annual salary, you would be receiving a monthly pre-tax salary of $4,166.67, a weekly pay of $961.54, and an hourly wage of $24.04 per hour.

If you earn $35,000 as an annual salary, you would be receiving a monthly pre-tax salary of $2,916.67, a weekly pay of $673.08, and an hourly wage of $16.83 per hour. Your weekly pay is either figured in terms of a salary that you earn each week regardless of the number of hours you work, or based on your hourly wage and the number of hours you work. Your gross weekly pay is the total amount you earn before your employer deducts the taxes that he must withhold and send to state and federal agencies.

Your net weekly pay is the amount that you actually receive in your paycheck once these taxes have been subtracted from the gross amount. If you have an annual salary of $60,000, it equates to a monthly pre-tax salary of $5,000, weekly pay of $1,153.85, and an hourly wage of $28.85 per hour. These figures are pre-tax and based upon working a 40-hour week for 52 weeks of the year. If you have an annual salary of $45,000, it equates to a monthly pre-tax salary of $3,750, weekly pay of $865.38, and an hourly wage of $21.63 per hour. If you have an annual salary of $30,000, it equates to a monthly pre-tax salary of $2,500, weekly pay of $576.92, and an hourly wage of $14.42 per hour.

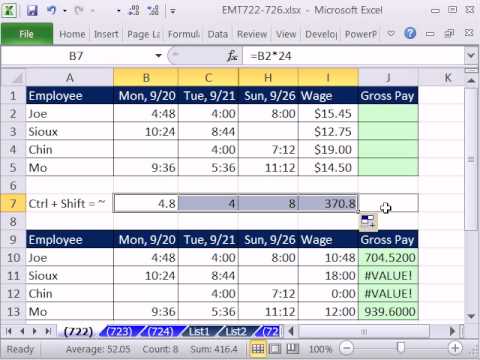

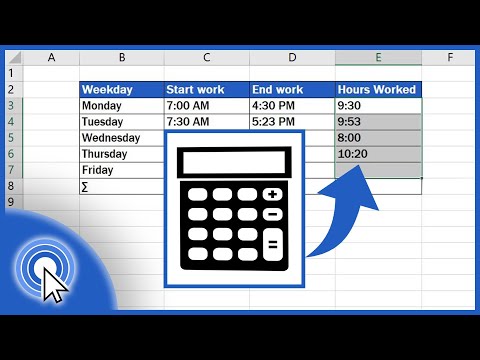

If you are paid on an hourly or daily basis, the annual salary calculation does not apply to you. Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid. Add the number of hours you worked each day of the weekly to calculate your total hours for the week.

Multiply this number by your hourly wage to calculate your gross weekly pay if your earnings are based on a wage rather than a salary. If you worked more than 40 hours during the week, multiply the first 40 hours by your regular weekly pay and multiply number of hours in excess of forty by 1 1/2 times your weekly pay . Understanding what gross wages mean is important because taxes and deductions are based on a percentage of the employee's gross wages. For employers, also knowing how to calculate the correct amount of federal and state income taxes, Social Security, and Medicare is important to your company, your employees, and the IRS. We also offer the options to enter the number of work weeks per year (typically around 50 for most, though 48 for some & 52 for others) along with the blended tax rate. If you have your paycheck in hand and do not know what the income tax rate is you can enter zero to convert a paycheck to other pay periods without estimating the impact of income taxes.

If you do know your rough bleneded income tax rate & the pre-tax earnings for a period of time then you can quickly calculate pre-tax & post-tax incomes. This salary calculator estimates total gross income, which is income before any deductions such as taxes, workers compensation, or other government and employer deductions. To determine your net income, you have to deduct these items from your gross annual salary. Note that deductions can vary widely by country, state, and employer. When you convert hourly to salary, it's important to consider deductions as well.

As it usual when comparing two things, we have both pros and cons for each of them. For example, if you are a monthly salary employee, you can count on more social benefits, like health insurance, parental leave, a 401 plan and free tickets to cultural institutions. For sure, full-time jobs consume much more of your time, the level of responsibility is higher, but they offer a possibility to develop your career. What might be motivating is a feeling of stability, thanks to the same amount of money you receive every month.

One of the crucial drawbacks of that kind of work might be not being paid for overtime, meaning you will not be compensated for any extra activities . How to calculate gross wages is different depending on whether the employee works full-time or part-time, or whether the employee is salaried or hourly. Employers can calculate gross wages on a quarterly, monthly, weekly, or daily basis—or for any other period of time they desire.

To calculate your hourly wage based upon your annual salary, start by dividing your salary figure by the number of hours you work per week. Then, divide the resulting figure by the total number of paid weeks you work each year. That will give you your hourly rate, which should be above the National Minimum Wage. To calculate your weekly wage you should then multiply your hourly rate by the average hours you worked in the 12-week period.

Calculating the gross wage for salaried workers is a little different because you start with their annual salary. If you want to determine the gross wages per month, you will simply divide the employee's annual salary by 12. For example, if the employee makes $55,000 per year and you want to calculate a monthly gross wage, you would divide the total salary by 12. Gross wages include all of an employee's pay before taxes and other mandatory and discretionary deductions have been taken out. The majority of an employee's gross wages typically consists of their base pay such as their salary, hourly pay, or tips (for tip-based workers).

You get a paycheck every couple of weeks and tax forms at the end of the year. In order to calculate an hourly rate based upon your monthly salary, multiply your monthly figure by 12 and then divide it by the number of hours you work per week. Divide this resulting figure by the number of paid weeks you work each year to get your hourly rate.

Convert your annual salary, monthly wage or weekly pay to an hourly rate and find out what you're earning per hour. Enter your current payroll information and deductions, then enter the hours you expect to work, and how much you are paid. You can enter regular, overtime and an additional hourly rate if you work a second job.

This calculator uses the 2019 withholding schedules, rules and rates . Use SalaryBot's salary calculator to work out tax, deductions and allowances on your wage. The results are broken down into yearly, monthly, weekly, daily and hourly wages.

This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate you are paid per hour. Follow the instructions below to convert hourly to annual income and determine your salary on a yearly basis. Use our wage calculator to work out your hourly wage using your annual, monthly or weekly paycheck figure and the number of hours you work. Freelancers' earnings are usually based on hourly or daily rates though, sometimes, they are based on weekly or monthly payments. And since working as a freelancer doesn't come with the many benefits that full-time employees enjoy, their pay must be higher than what full-time employees would relatively earn. In our contemporary supply-demand-driven environment, however, we often see that the rates are under pressure.

How Do I Calculate My Hours Per Week When you're done, click on the "Calculate!" button, and the table on the right will display the information you requested from the tax calculator. You'll be able to see the gross salary, taxable amount, tax, national insurance and student loan repayments on annual, monthly, weekly and daily bases. When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It's important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn't.

Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

It's your employer's responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. As you can see, lots of aspects depend on that what is important to you, what kind of contract you have and what your employer offers you in a particular company.

For some people, health insurance might be more important than flexibility in working hours. Consider all of the pros and cons before you choose between salary and hourly employment. One of the hourly-employee benefits is that your hours maybe more flexible - no 9 to 5, 5 days a week. That provides more freedom and can lead to better time management. On the other hand, while your weekly shifts are very irregular, it might be frustrating because you feel disorganized.

Then, when you'll multiply your weekly income as shown on the calculator by 52 , you'll get your annual earnings. Let's say you're earning $25 an hour and that you work 40 hours per week, then you'll see that your annual income is $25 x 40 x 52, which is $52,000. Employers withhold federal income tax from their workers' pay based on current tax rates and Form W-4, Employee Withholding Certificates. When talking about payments in specific job positions, we often use the term salary range.

In fact, the meaning is depending on if you are an individual or a company's financiers. From an employee's viewpoint, salary range includes compensation parameters, such as overtime, as well as including benefits, like a company car or health insurance. On the other hand, for the company, it will be the amount that it is able to pay a new employee for a particular position and how much current employees can expect to earn in that specific position.

Usually, companies cannot make exceptions from the salary ranges, because the numbers are strictly determined by its budget. If you work 40 hours a week, but clock out for a half an hour lunch a day, you only get paid for 37.5 hours per week. Multiply the number of hours you work per week by your hourly wage. If you make $20 an hour and work 37.5 hours per week, your annual salary is $20 x 37.5 x 52, or $39,000. If you make $60,000 a year, your hourly salary is approximately $30 an hour.

Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance. Calculate gross pay, before taxes, based on hours worked and rate of pay per hour including overtime.

To enter your time card times for a payroll related calculation use this time card calculator. In the U.S., according to the payment rules regulated by the Fair Labour Standards, salary workers are not covered by overtime . It is worth mentioning, that in many countries companies offer their workers various kind of compensations for overtime hours.

That might be just additional money, time off adequate to the number of overtime hours, or other benefits. When a salaried employee is classified as non-exempt under Fair Labour Standards, an employer has to pay one and a half for each extra hour over standard 40 per week. To avoid misunderstandings, clear all your doubts in your state's Department of Labour or your country's labour law. In the U.S., the Fair Labor Standards Act does not require employers to give their employees any vacation time off, paid or unpaid. Therefore, when interviewing and deciding between jobs, it may be wise to ask about the PTO policy of each potential employer.

With that said, the average American gets around 10 days of PTO a year; the bottom 25% of wage earners only get an average of four paid vacation days a year. Most companies tend to institute a policy that increases the amount of PTO an employee gets every several years or so as an incentive to retain workers. Another aspect to keep in mind when determining income is the value of your benefits, particularly when deciding whether to accept a new job. The two most common benefits are health insurance and retirement plans. It may be better to accept a lower salary if your employer is willing to cover 100 percent of your health premiums.

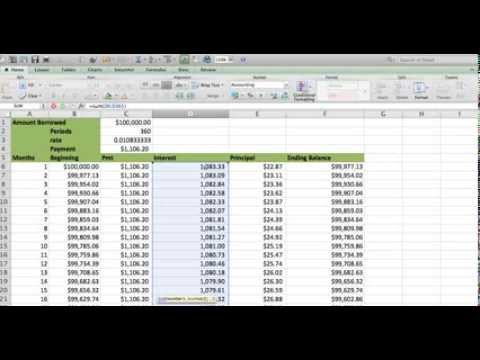

Determine the amount that you will have to pay for your premiums and subtract that from your annual salary to figure how much you'll actually be bringing home. Generally, salaries will get paid after a certain amount of time, usually on a weekly, 2-weekly, semi-monthly, or monthly basis. And because counties and states want to protect employees, many of them have introduced minimum wages that are enforced by central or local governments. The table shown below explains how the income results are determined. Simply fill in your hourly earnings and the number of hours you work, and you'll see how that translates to your weekly, monthly, and annual pay.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. The following calculations are used to determine hourly, daily and weekly rates of pay from annual salary. If this is the case, you will need to calculate your average hourly rate over a 12-week period before working out your weekly pay.

If your overtime payments or bonuses are subject to pension contributions, tick these boxes (these apply automatically to auto-enrolment pensions). The money for these accounts comes out of your wages after income tax has already been applied. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run.